Effective June 21, 2019, if a consignor, consignee or transporter fail to file his GST returns for 2 back to back months he will be banned from producing e way bills for the transportation of his merchandise. Also, for composite sellers, who are required to file quarterly returns will be banned from E way bill making, if their returns have not been filed for two sequential filing periods which is a half year.

The requirement for GSTIN blocking

Multiple times, a taxpayer can’t file his GST returns, purposefully or accidentally. But, because of these missing invoices, the provider can’t claim ITC for taxes he has paid. Besides, the blocking of GSTIN for Eway bill making is additionally being touted as an Anti-avoidance step to support the income and increment GST compliance.

Whether the blocked GSTIN be unblocked?

In case your GSTIN has been blocked on the EWB gateway due to Non-Compliance, it tends to be unblocked as given:

Automated GSTIN unblocking

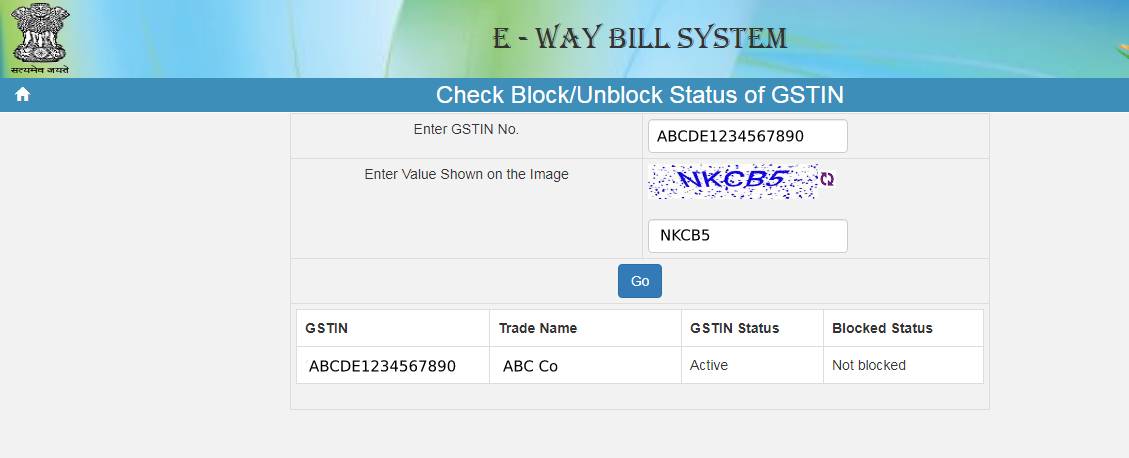

The GST Common Portal blocks the EWB generation without GSTR filing for 2 back to back months. However, soon the consignor, consignee or transporter files his GSTR 3B, the block status is naturally updated as ‘Not Blocked’ in a day in the e-waybill system and the taxpayer will have the option to create EWB again.

Image source – irisgst

Manual GSTIN unblocking?

Usually, the regular portal automatically refreshes the blocking status of the GSTIN in a day’s time of GSTR 3B filing. However, if you are as yet not ready to create Eway Bill, you can manually revive the GSTIN block status on E-way bill gateway as given:

- Select Update Block Status from the inquiry tab.

- Enter the GSTIN and Captcha Value

- Also, click on ‘Update GSTIN from Common Portal’.

This will bring the status of Filing from GST Common Portal and whenever filed, the status in e-way bill framework will accordingly get updated

GSTIN Blocking alert

In case if a taxpayer has not filed his return for over 2 months, he will get alerts saying, “e-Way bill generation may be blocked after few days as you have not filed last two months successive returns at GST Common Portal” while creating Eway on the common portal.

IRIS GST is a leading GST Suvidha Provider (GSP) in India, giving a simple and productive solution for GST (IRIS Sapphire) and E-way bill (IRIS Topaz) compliance.

Enquire with Certicom Consulting in case of any queries.