How to know your UAN?

a. Through Employer

In the normal case, you can easily get your UAN from your employer allotted to you. Some employers print the UAN number in the pay slips.

b. Through UAN Portal using PF number/member ID

It is possible, that you are unable to get your Universal Account Number from the employer, you can obtain the UAN number through UAN portal also. Follow the below steps:

Step 1: Go the UAN Portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Click on the tab ‘Know your UAN Status’. The following page will be displayed.

Step 3: Select your state and EPFO office from the drop-down menu and enter your PF number/member ID awith the other details. You can get the PF number/member ID from your salary slip. Enter the tab ‘Get Authorization Pin’.

Step 4: You will get an OTP on your mobile number.

Step 5: Your Universal Account Number will be sent to your mobile number.

3. How to activate and log in to the EPFO website using UAN?

In order to activate UAN, it is essential that you have your Universal Account Number and PF member id with you. Given below are steps to activate.

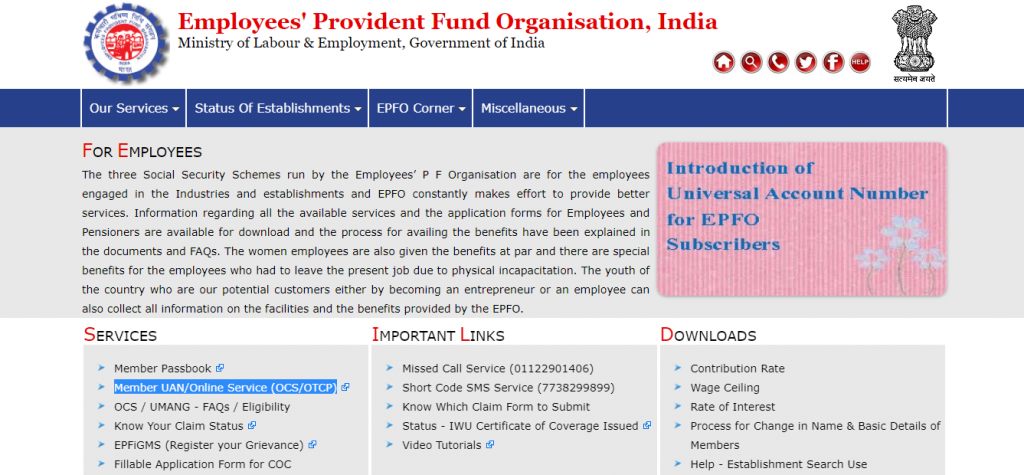

Step 1: Go the EPFO homepage and click on ‘For Employees’ under ‘Our Services’ on the dashboard.

Step 2: Click on ‘Member UAN/Online services’ in the services section. You would reach the UAN portal.

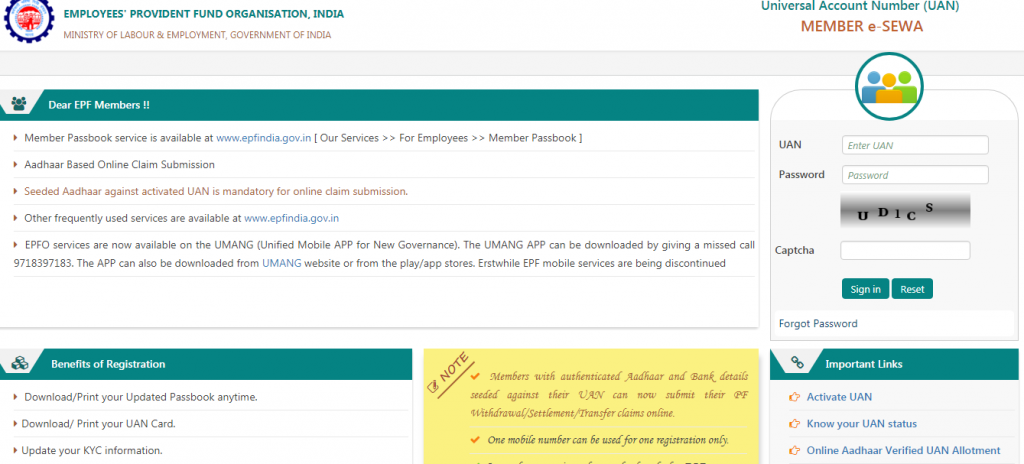

Step 3: Do you have any questions about tax or finance you need help with?

- Enter your UAN, mobile number and PF member ID. Enter the captcha characters. Click on ‘Get authorization PIN’ button. You will receive the OTP on your registered mobile number.

- Click on ‘I Agree’ under the Disclaimer checkbox and enter the OTP that you receive on your mobile number and click on ‘Validate OTP and Activate UAN’.

- On activation of the UAN, you will receive a password on your registered mobile number to access your account.

4. Advantages of UAN to employees

- Every new PF account with a new job will come under the umbrella of a single unified account.

- It is easier to withdraw (fully or partially) PF online with this number.

- Now the employees themselves can transfer PF balance from old to new using this unique account number.

- Any time you want a PF statement (visa purpose, loan security etc.), you can download one instantly – either by logging in using member ID or UAN or by sending an SMS.

- There will be no need for new employers to validate your profile if the UAN is already Aadhaar and KYC-verified.

- UAN ensures that employers cannot access or withhold the PF money of their employees.

- It is easier for employees to ensure that his/her employer is regularly depositing their contribution in the PF account.

5. Benefits & Features of UAN

- Universal Account Number or UAN helps to centralize employee data in the country.

- One of the biggest use of this unique number is that it brings down the burden of employee verification from companies and employers by EPF organization.

- This account made it possible for EPFO to extract the bank account details and KYC of the member and KYC without the help of employers.

- It is useful for EPFO to track multiple job switches of employee.

- Untimely and early EPF withdrawals have reduced considerably with the introduction of UAN.

6. Documents required to open UAN

If you have just entered your first job or first job in a registered company, you require the following documents to get your Unique Account Number.

- Bank account info-account number, IFSC code, branch name.

- ID Proof – Any photo-affixed and national identity card like Driving License, Passport, Voter ID, Aadhaar, SSLC Book

- Address Proof: A recent utility bill in your name, rental/lease agreement, ration card or any of the ID proof mentioned above if it has your current address

- PAN card – Your PAN Number should be linked to UAN

- Aadhaar Card – SInce Aadhaar is linked to the bank account and mobile number, it is mandatory.

- ESIC card

[frontpage_news widget=”879″ name=”Certicom – A Group of Chartered Accountants – Articles”]