E-way Bill blocking for non-payers will resume from August 15

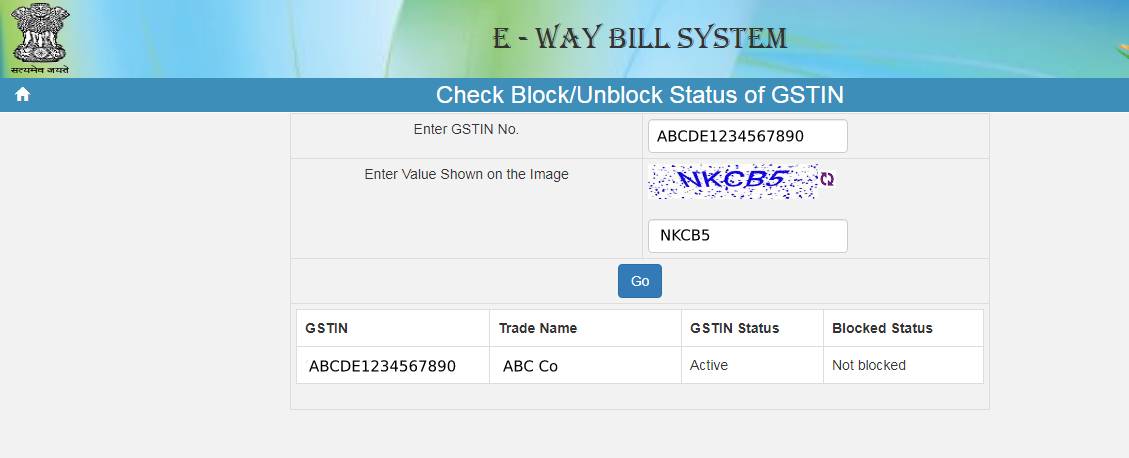

For taxpayers who have not filed two or more outbound supply returns by June 15, the government will begin banning e-way bill creation.

The Goods and Services Tax Network published a bit of advice to that effect on Thursday, notifying taxpayers and recommending them to file pending returns to avoid e-way bill blocking.

“After August 15, 2021, the system will check the status of returns filed in Form GSTR-3B or statements filed in Form GST CMP-08, and restrict the generation of EWB in the case of non-filing of two or more returns in Form GSTR-3B for the months up to June 2021, and non-filing of two or more statements in Form GST CMP-08 for the quarters up to April to June 2021,” according to the statement.

[pt_view id=”c8bb8e9z6d”]

Due to the epidemic, the ability to restrict the generation of e-way bills was temporarily disabled. If a GSTR-3B return has not been filed for two consecutive quarters, Rule 138E gives the authority to limit EWB generation.

If outbound supplies returns by regular taxpayers and those under the composition scheme are not filed within the next 10 days, the blocking of e-way bill generation will be a hindrance to company operations, according to experts.

GSTN has raised a red signal for all non-filers of GST returns, and their activities would come to a standstill on August 16 due to the blockage of e-way bill generation.

“Blocking e-way bill creation will have a direct impact on non-compliant enterprises and may have a spillover effect on large businesses,” said Rajat Mohan, senior partner at AMRG Associates.

SECTION 206AB- SPECIAL PROVISION FOR DEDUCTION OF TAX AT SOURCE FOR NON-FILERS OF INCOME-TAX RETURN

“As company operations return to normal, industry players should file their tax returns in a timely manner, or their e-way bill generation would be prohibited, limiting movement of their goods,” said Abhishek Jain, tax partner at EY.